Intralinks and Precision LM

Supporting the entire commercial real estate financing deal lifecycle

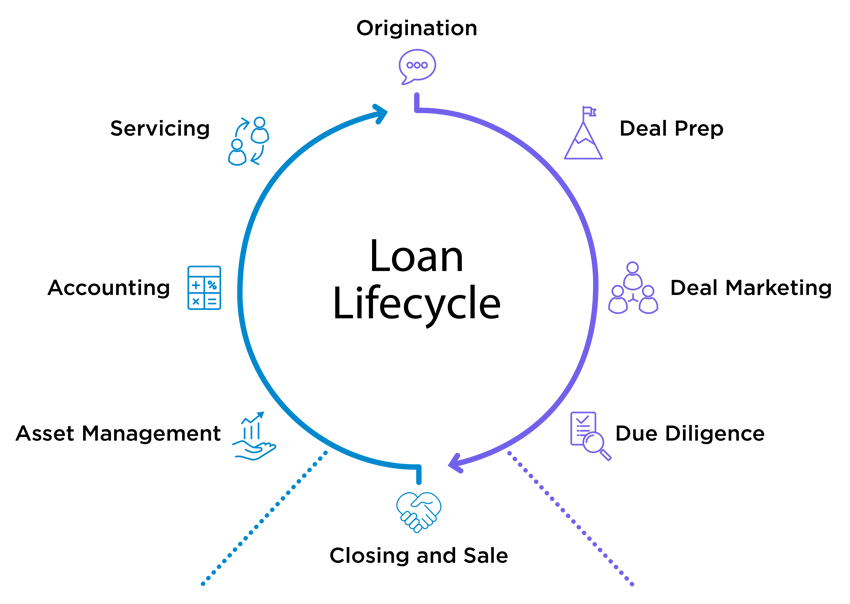

SS&C provides market-leading technology solutions to support the entire commercial real estate financing lifecycle – from loan origination through closing, and post-close servicing, accounting and asset management.

Precision LM

The key to Precision LM’s value for commercial/multifamily lenders and servicers is its integrated and comprehensive design – eliminating inefficient, disparate systems and manual processes.

This single platform approach addresses all aspects of the loan life cycle, among them pipeline tracking, servicing and accounting, asset management and investor reporting. You get better results derived from straight-through processing delivering immediate, accurate information, with the utmost flexibility to align with the way you do business.

Asset Management

- Upload, store and report on financial statements, rent rolls, appraisals and inspections

- Covenant Tracking, Watchlist and CREFC IRP Reporting

- Distressed Debt, Forbearance, Modifications & Workout

Accounting

- Robust multi-basis and multi-currency accounting

- Track fees and expenses, and defer/amortize over the life of the loan

- Configurable accounting policies to meet your requirements

Servicing

- Real-time payment and transaction processing

- Automated Money Movement, Bank Reconciliation & Treasury Management

- Responsive borrower self-service web portal for secure 24x7 access to loan information

Intralinks

Intralinks provides the most comprehensive platform for CRE issuers and deal teams, combining our best-in-class virtual data room VDRPro™, DealMarketing™ to streamline investor outreach and track engagement, advanced security features – including data encryption in-transit and at-rest, granular permissioning, document retraction and redaction, and compliance reporting with full audits of user activity.

As the first among its peers to obtain ISO-27701 certification, Intralinks meets the highest standards of data privacy and protecting customer information.

Origination and Deal Prep

- Collaborate with borrower teams via a VDR

- Share and view market updates, funding plan, debt comps, financial models and more

- Set up a prep VDR to stage and structure documents and folders for the actual deal

Deal Marketing

- Streamline investor outreach

- Send presale documents, prospectuses and offering memos

- Conduct a virtual roadshow

- Track activity and gauge investor engagement

- Begin book building

Due Diligence

- Centralize and secure documents

- Facilitate efficient credit risk analysis

- Consolidate and manage questions and answers (Q&A) between stakeholders

Closing and Sale

- Maintain complete archive of all deal documents

- Access reports of all deal activity

- Use archive for compliance reporting or secondary loan sales

eBook

10 Considerations That "Lend" Credibility to Private Market Investing

Private lending portfolios are complex. Managing them doesn’t have to be.

Brochure

Lender's Viewpoint Portal

Gain transparency, insight and control over your loan portfolio through a secure, modern web-based interface.

Brochure

Protect Your Data with Industry-Leading Security

Intralinks' integrated security model provides the processes, controls and reporting required by the most regulated industries to protect data and reduce risk.

Brochure

Intralinks VDRPRo

The pioneering virtual data room (VDR) for the financing deal lifecycle is now better than ever. With state-of-the-art features and performance upgrades, capital markets professionals can work even more productively to reach investors faster and get deals done.

Brochure

Intralinks DealMarketing

Timing is everything for dealmakers in today’s hyper-competitive, remote working world. Intralinks DealMarketing gives deal teams a faster route to investors and a clearer view of the best prospects.